The Second World War ended in September 1945, and until that date, Turkey tried not to enter the war. It was feared that, a country that has not yet recovered would experience a greater decline in this war. However, contrary to what is thought, although Turkey did not enter the war, it took many social and economic measures, and this situation had a great impact on society. These effects can also be understood from the measures taken by the state and legal measures. The problems experienced during the First World War, came to light one by one. Although Turkey remained neutral, it had to follow the war with a large army, and even if the government led by İsmet İnönü protected Turkey from the destruction of the hot war, it could not keep the country out of the war economy (Çetin, 2007: 72). The Second Five-Year Industrial Plan was interrupted due to the war and instability in the economy came to the fore. Therefore, both foreign and domestic economic policies could not be implemented, foreign trade was interrupted, and production decreased. In addition, inflation has occurred, the budget allocated by the government to the measures taken has increased, which has considerably reduced the quality of life. The black market has become inevitable due to the decrease in production and the interruption of foreign trade due to the participation of the productive population in armed measures. There was a community that made a lot of money by selling basic necessities at incredibly high prices through the black market and stockpiling, and there were also low- and middle-income people who had to spend all their money for their basic needs. This situation led to the formation of two disjointed strata and a large gap between these communities. In this period when even the basic needs are hardly met, it has become a normalized situation for people to get diseases such as tuberculosis and to lose their lives.

The end of the Second World War coincided with a period when opposition voices began to be heard in Turkey, apart from the CHP. The issues that were tried to be covered up on the media are now being discussed and criticized. The free economy was defended against the statism implemented by the CHP. Against these criticisms, the CHP could not protect itself and contradicted itself. This situation can be explained as the CHP started to lose some of its legitimacy and power.

These situations caused Turkey to go into a political, economic and social depression and to get out of this situation, National Protection Law and Wealth Tax laws were enacted.

NATIONAL PROTECTION LAW

Turkey, which had not entered the heat of the Second World War, was also in a great economic depression like most countries. One of the official measures taken to prevent this situation is the National Protection Law. This law can be counted as the law that gave the most power to the government during the war. Before 1939, government had a report called ‘Defense Economy’ prepared. Taking this report as an example, the draft law named National Economic Law has been prepared. However, discussions have started that this draft law is unconstitutional due to some of the privileges it provides to the government. In response to these reactions against the law, a group under the presidency of Recep Peker prepared a new text by making some changes and this text was officially accepted on January 18, 1940. The National Protection Law gave some duties and powers to the government for an extraordinary situation that might occur. In this way, the interventions of the state became legitimate (Çavdar, 1995: 425).

Due to this law, the government gained the right to have a say over industrial and mining organizations to both control and determine the amount and characteristics of production. The government could buy and stock certain goods at their own value and sell them unprofitably to the organization it felt needed. The working hours of workers, other than children and women, could be increased by three hours each day. Holidays could be ignored for the period this law was in effect. Consumption of certain goods could be prohibited or limited. Housing expenses would not exceed the limits of 1939. Adults engaged in agricultural work would be able to work as paid in another agricultural business close to their home, provided that they did not disrupt their own work. The government would be able to provide products where it deems necessary and could decide on the type and amount of the product to be produced. Those with more than eight hectares of land could be compelled to use half of their land for grain cultivation. Farmers were compelled to sell their grain to the Turkish Grain Board at very low prices, except for the amount they set aside for subsistence and seeds. Bread in amounts adjusted for age and work could only be bought with a ration card. In addition, on February 18, 1941, Petrol Ofisi was established by the National Protection Law (Aydın, 2019: 419).

Thanks to the National Protection Law, the government was able to take direct decisions about the amount, form, and scale of production. It is strictly forbidden to develop price policies or stockpiles that do not comply with these decisions. For those who oppose these prohibitions; prohibition from trade, the closing of their businesses, heavy fines, and even imprisonment for certain periods have been added to the law (Öztürk, 2013: 142). The government has also mentioned the specially authorized courts that will be authorized only on this issue. The police measures brought by the National Protection Law also caused injustice, theft, and cruelty (Yenal, 2001: 101). Despite all the sanctions, the continuation of the black market and stockpiling both worsened the situation, and the atmosphere of peace was further lost as the reactions to the state intervention became widespread among the people. In addition, the fact that the National Protection Law victimized small producers rather than large producers and caused the society to divide into two poles brought a dimension of social crisis.

The National Protection Law did not achieve its purpose, unfortunately. Small producers continued to be victims and social stratification was caused. The reaction to the state increased due to the interventions made by the police and the police force. The lack of freedom even at the lower limit affected people deeply, and this failure of the CHP caused it to fall out of the public eye and lose its credibility. This situation was remembered as a failure to be used against the CHP later on. The first indication of this situation is that the Democratic Party government won the elections.

WEALTH TAX

Şükrü Saraçoğlu took office in place of Refik Saydam, who died on July 8, 1942. Saraçoğlu believed that the National Protection Law should be softened a bit and released the prices of many goods with controlled prices. Thus, he believed that even if the free economy increased the prices, it would prevent the black market and that the prices would then find the equilibrium. Despite this though, the black market did not end and the increase in prices caused the famine to be experienced on a larger scale. The big producers again earned more and the distance between them and the small producers got wider. The idea of imposing a new tax on behalf of the relief of the Turkish economy, which was struggling under the heavy burden of the war, came to the fore in the autumn months of 1942 (Dokuyan, 2014: 31). The wealthy ones of the period were invited to help and donate. A sensitivity campaign has started on this issue.

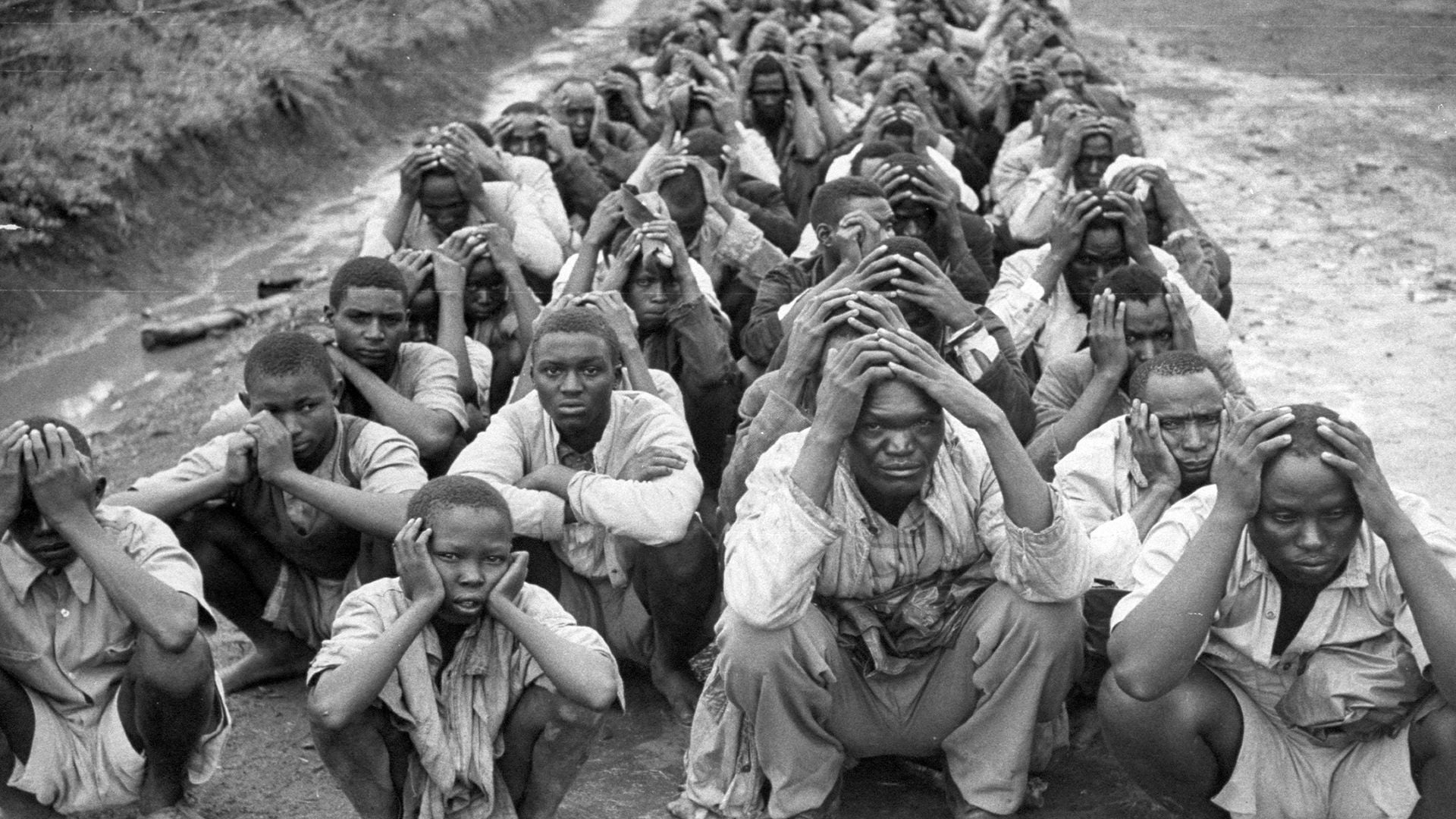

On November 12, 1942, the Wealth Tax Law was passed. It is stated that the Wealth Tax will be collected only once. The Wealth Tax aimed to postpone Turkey’s problems, reduce inflation, increase the country’s income and balance the economy. Income and depression taxpayers, large farmers, those who have a gross annual income of 2500 TL per year for their buildings and shareholdings, and whose land has a tax registered value of more than 5000 TL, have not been able to work after the announcement of the Wealth Tax, although they have been paying income and depression tax since 1939. Even if their profession was not commerce, those who made money from commercial activity since 1939 were also obliged to pay the Wealth Tax by law (Çavdar, 1995: 431). Although, it was accepted that the gains of those who gain unfairly during the war and opportunists would be taxed, but it was not so. It has been accepted that there will be taxation in the amounts determined by the commissions in the provinces and districts, but there is no way to object to these determined amounts. It has been reported that the property of persons who do not pay their debts within the given period will be foreclosed. It was decided to send those who did not pay under all conditions to a labor camp in Aşkale. More than two thousand people were sent to these camps.

29% of the Wealth Tax was taken from the Muslim people, 52% from the non-Muslims, and the remaining foreigners. Considering these rates, it is one of the ideas put forward that the Wealth Tax is trying to create a new and Turkish bourgeois society by Turkifying the capital in the hands of foreigners. It has been observed that after the law came into force and was put into practice, it took on a structure that generally concerns minorities. Considering the economic situation of the Muslim-Turkish people in the post-war years, it is stated that the non-Muslim people live in prosperity. Therefore, in the implementation phase of the Wealth Tax, although it has a structure that concerns the whole society, it has taken on a structure where minorities are addressed (Kovancılar & Kayalıdere, 2012: 156). Şükrü Saracoğlu’s sentence, “This law is a law of revolution. We are in front of an opportunity that will give us our economic independence. Thus, we will eliminate the foreigners who dominate our market, and we will put the Turkish market in the hands of the Turks” (Bakkal, 2003: 100), also strengthens this idea. Wealth Tax is not a positive development for the history of a country that is trying to democratize and is in this process. The Turkish press of the period could not speak up, but they supported this taxation. On the other hand, it was on the agenda of the foreign press and received heavy criticism. As a result, the targeted amount of money could not be collected, approximately 315 million TL, and the CHP lost its legitimacy and credibility in the eyes of the people, as in the National Protection Law.

CONCLUSION

Although Turkey did not enter the Second World War, it tried to take many precautions and prepare for this war, since the possibility of entering the war was always alive. This preparation took place in military, economic and social fields. Although it was a war period, opportunity hunters sought to abuse this situation. It is an inevitable fact that many wrong behaviors such as the black market and corruption should be sanctioned. However, the measures taken and the laws enacted affected the low and middle-income part of the people rather than the opportunity hunters. These laws, which were enacted by choosing wrong methods and having wrong predictions, still maintain their importance in history.

Prepared by Zeynep AKYÜZ for The FEAS Journal.

REFERENCES

Aydın, M. (2019) Milli Korunma Kanunun Hayata Geçirilişi ve Tek Parti Dönemi Uygulamaları, p.419.

Bakkal, U. (2003) Varlık Vergisi Kanunu’nun Maliye Teorisindeki Vergilendirme İlkeleri Çerçevesinde Değerlendirilmesi, p.100.

Çavdar, T. (1995) Türkiye’nin Demokrasi Tarihi: 1839-1950, p.425-433.

Çetin, H. (2007) İkinci Dünya Savaşı Sürecinde Türkiye’nin Sosyo-ekonomik Durumu, p.72.

Dokuyan, S. (2014) Savaş Ekonomisi ve Varlık Vergisi Üzerine Bir Değerlendirme, p.31.

Kayalıdere, G. & Kovancılar, B. (2012) Mali Sosyoloji Üzerine Denemeler, p.156.

Öztürk, İ. (2013) İkinci Dünya Savaşı Türkiye’sinde Olağanüstü Ekonomik Kararlar, p.142.

Yenal, O. (2001) Cumhuriyetin İktisat Tarihi, p.101.