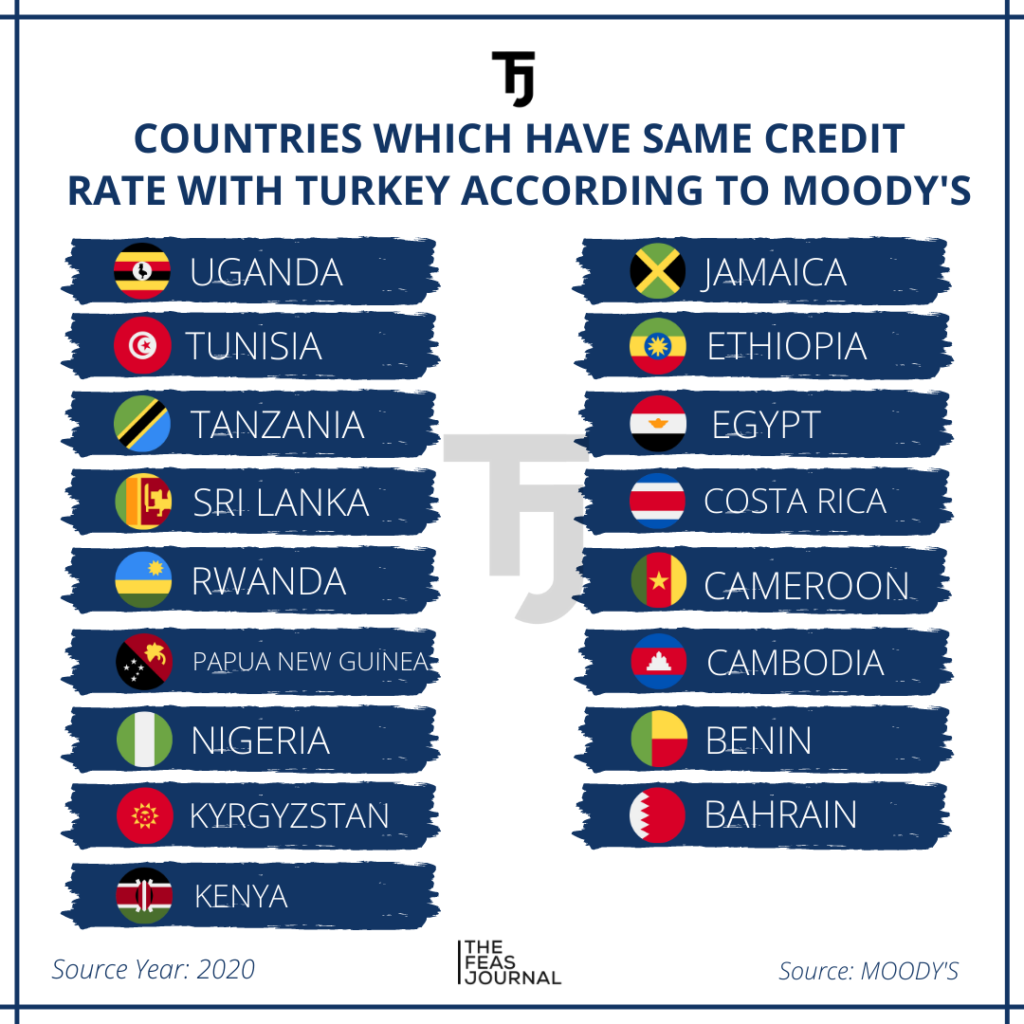

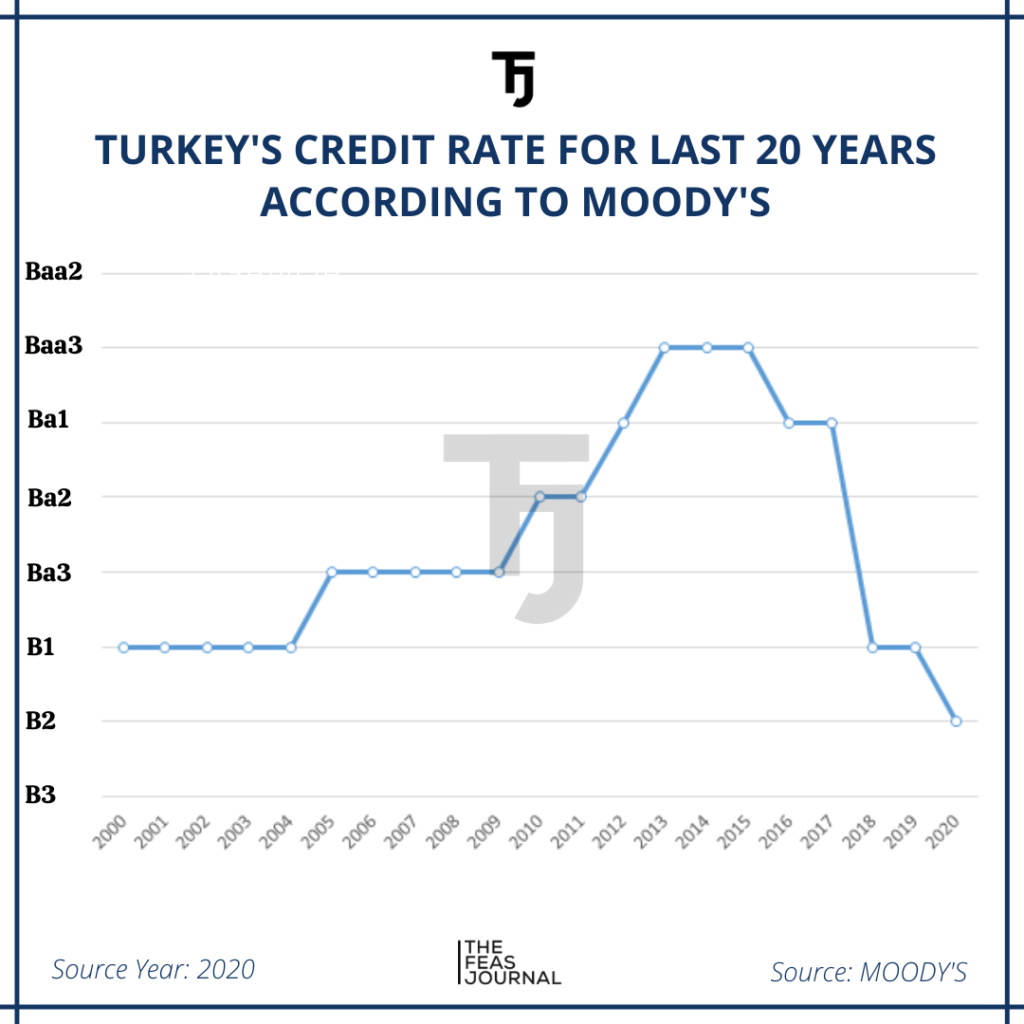

Moody’s, which is an International Credit Rating Agency, decreased the Credit Rating of Turkey from B1 level to B2 level. This grade is 5 notches below the investment grade. The Republic of Turkey didn’t fall at this level even during the largest economic crisis of her history in 2001. There are countries such as Uganda, Tunisia, Tanzania, Sri Lanka, Rwanda, Papua New Guinea, Nigeria, Kyrgyzstan, Kenya, Jamaica, Ethiopia, Egypt, Costa Rica, Cameroon, Cambodia, Benin, and Bahrain with Turkey in this level.

Moody’s statement in the reasoning of the decision that “external fragilities are likely to result in a balance of payments crisis”, pointing to the sharp decline in reserves and the growing tension in the Eastern Mediterranean. Along with this downgrade, the outlook was confirmed as “negative”. The decision was a “surprise” because Moody’s would give the dates June 5 and December 4 for the grading. Grade levels of B1, B2, and B3 are considered as “highly speculative” in Moody’s classification.

The three key drivers for the downgrade are:

1. Turkey’s external vulnerabilities are increasingly likely to crystallise in a balance of payments crisis.

2. As the risks to Turkey’s credit profile increase, the country’s institutions appear to be unwilling or unable to effectively address these challenges.

3. Turkey’s fiscal buffers, which have been a source of credit strength for many years, are eroding.

The maintenance of the negative outlook reflects the view that fiscal metrics could deteriorate at a faster pace than currently anticipated in the coming years. It also reflects the downside risks associated with the authorities’ inadequate reaction function, which makes Turkey more likely to suffer a full-blown balance of payments crisis in the coming years. Finally, it reflects elevated levels of geopolitical risk on several fronts—the relationship with the United States (the US, Aaa stable), the relationship with the European Union (EU, Aaa stable), and tensions in the Eastern Mediterranean—that could be an accelerant for any crisis.